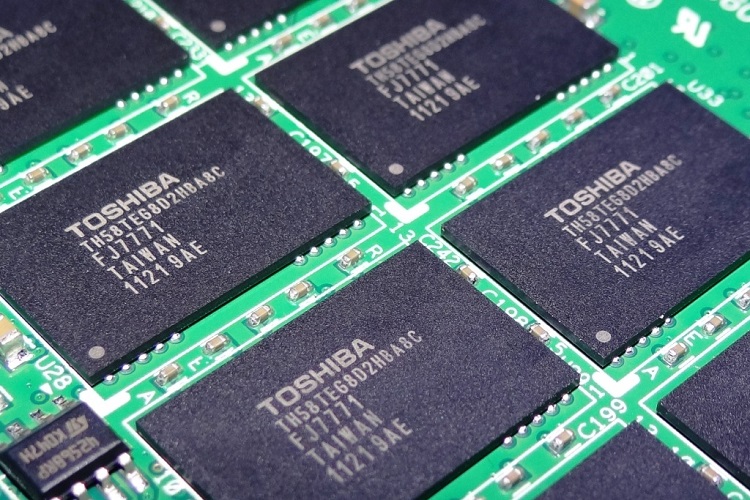

Toshiba negotiates the sale of TMC to a Bain Capital led consortium

Toshiba negotiates the sale of TMC to a Bain Capital led consortium

Â

Â

Western Digital has since released a statement that shows their distaste for this new proposal, given SanDisk’s joint ventures with Toshiba. SanDisk is owned by Western Digital, who fears that any deal between Toshiba and SK Hynix/Bain will allow research from their joint ventures to be given to SK Hynix (a competitor).Â

Western Digital also wants to secure TMC for themselves, given the spike in demand for NAND in recent years in devices that range from smart devices and consumer PCs all the way to servers. Â

Â

We are disappointed that Toshiba would take this action despite Western Digital’s tireless efforts to reach a resolution that is in the best interests of all stakeholders. Throughout our ongoing dialogue with Toshiba, we have been flexible, constructive and have submitted numerous proposals to specifically address Toshiba’s stated concerns. Our goal has been – and remains – to reach a mutually beneficial outcome that satisfies the needs of Toshiba and its stakeholders, and most importantly, ensures the longevity and continued success of the JVs.Furthermore, it is surprising that Toshiba would continue to pursue a transaction with a consortium led by Korea-based SK Hynix Inc. and Bain Capital Japan without SanDisk’s consent, as the language in the relevant JV agreements is unambiguous, and multiple courts have ruled in favor of protecting SanDisk’s contractual rights. We remain confident in our ability to protect our JV interests and consent rights.

Â

Â

Toshiba wants to close this deal as soon as possible, given the company’s dire financial situation, hopefully allowing the company to return to a positive net following the company’s recent financial disasters.

Â

You can join the discussion on Toshiba’s potential sale to Bain Capital on the OC3D Forums.

Â

Toshiba negotiates the sale of TMC to a Bain Capital led consortium

Â

Â

Western Digital has since released a statement that shows their distaste for this new proposal, given SanDisk’s joint ventures with Toshiba. SanDisk is owned by Western Digital, who fears that any deal between Toshiba and SK Hynix/Bain will allow research from their joint ventures to be given to SK Hynix (a competitor).Â

Western Digital also wants to secure TMC for themselves, given the spike in demand for NAND in recent years in devices that range from smart devices and consumer PCs all the way to servers. Â

Â

We are disappointed that Toshiba would take this action despite Western Digital’s tireless efforts to reach a resolution that is in the best interests of all stakeholders. Throughout our ongoing dialogue with Toshiba, we have been flexible, constructive and have submitted numerous proposals to specifically address Toshiba’s stated concerns. Our goal has been – and remains – to reach a mutually beneficial outcome that satisfies the needs of Toshiba and its stakeholders, and most importantly, ensures the longevity and continued success of the JVs.Furthermore, it is surprising that Toshiba would continue to pursue a transaction with a consortium led by Korea-based SK Hynix Inc. and Bain Capital Japan without SanDisk’s consent, as the language in the relevant JV agreements is unambiguous, and multiple courts have ruled in favor of protecting SanDisk’s contractual rights. We remain confident in our ability to protect our JV interests and consent rights.

Â

Â

Toshiba wants to close this deal as soon as possible, given the company’s dire financial situation, hopefully allowing the company to return to a positive net following the company’s recent financial disasters.

Â

You can join the discussion on Toshiba’s potential sale to Bain Capital on the OC3D Forums.

Â