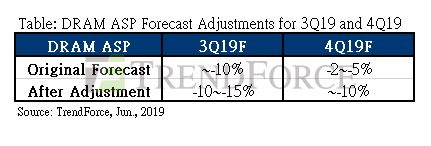

DRAM pricing is expected to drop faster than expected – Huawei ban partially to blame

DRAM pricing is expected to drop faster than expected – Huawei ban partially to blame

Much of this change is laid at the feet of the US ban on Huawei, which will hamper the shipments of both smartphone and server products for several quarters. These products require DRAM, making Huawei’s lower sales leaving more DRAM within an already saturated market.Â

Q3 and Q4 are traditionally the seasons of peak DRAM pricing, thanks to the seasonal demand for laptops, notebooks and other computing devices. Lowering DRAM pricing in these quarters is a bad sign for DRAM manufacturers, as it means that some of them may lose money in the coming quarters due to lowering prices market oversupply. Margins are getting thinner, and manufacturers are creating too much DRAM. Â

This is a good thing for consumers, as cheaper DRAM will enable PC builders to acquire DRAM more cheaply, system builders to create PCs at lower prices and would allow devices to feature more DRAM at a lower price premium. That said, DRAM pricing is likely to increase as we move into 2020, as the cost of DRAM is expected to hit rock bottom in the coming quarters, at least according to Trendforce.Â

You can join the discussion on DRAM pricing being set to drop at a faster rate than expected on the OC3D Forums. Â

You can join the discussion on DRAM pricing being set to drop at a faster rate than expected on the OC3D Forums. Â